By John H. Robinson, September 2022 Every year, I write at least an article or two aimed at dispelling the myths that estate planning exists solely in the realm of attorneys and that the estate … [Read more...] about Estate Planning is So Much More Than Drafting Documents

Estate Planning

How Many IRAs Do You Need?

How Many IRAs Do You Need?

How Many IRAs Do You Need? By Laurey Shintani, June 21, 2022 Pop Quiz: What is the maximum number of traditional or Roth IRAs a taxpayer may establish? Answer: There is no limit. While … [Read more...] about How Many IRAs Do You Need?

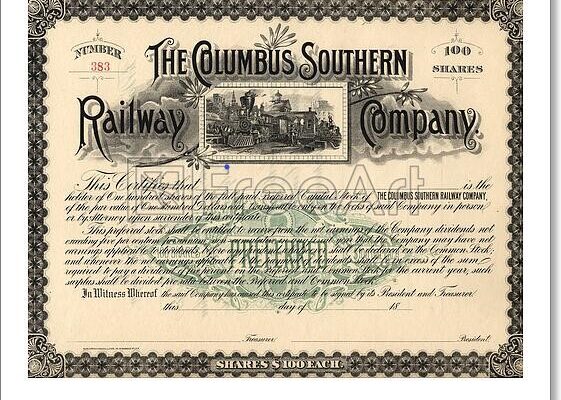

Old Stock Certificates Can Cause Major Headaches

Old Stock Certificates Can Cause Major Headaches

By Laurey Shintani, March 1, 2022 Before the digital age, it was customary, even fashionable, for investors to take physical delivery of the shares of stock they purchased from their stockbrokers. … [Read more...] about Old Stock Certificates Can Cause Major Headaches